Microfinance Sector for SMEs and Entrepreneurship

SMEs are the backbone of the Palestinian economy. This sector which makes up more than 98% of the operating establishment in Palestine and is the largest employer of the Palestinian workforce. Accordingly, PIF launched a range of programs and projects that aim at strengthening this sector, enabling small businesses to access needed financing to develop their commercial activities.

Ibda’a / Youth Entrepreneurs Capacity Building

The project was launched in 2016 and aims to contribute to fostering an entrepreneurial culture in Palestine by promoting entrepreneurship education and awareness among youth and providing them with the necessary financial and non-financial support to start sustainable small enterprises and create decent job opportunities.

In 2018, PsDF implemented all the activities related to implementing the Know About Business (KAB) Program and will handle the program to the MoEHE to ensure sustainability. We managed to institutionalize the Know About Business program in 36 technical colleges and were able to reach teachers at vocational schools in West Bank in 2018.

PsDF will continue implementing The Generate Your Business Idea (GYBI) and Start Your Business (SYB) Programs, with local partner institutions. We are planning to reach more youth willing to start their businesses through building new partnerships. In 2018 PsDF and local partner institutions managed to find 30 new businesses in different areas in WB. And we are looking forward to establishing new partnerships to ensure reaching more youth willing to start their businesses.

Ibda’a / Youth Entrepreneurs Financing

The youth entrepreneurs financing program “IBDA’A” was launched in 2016, as a result of fruitful cooperation between Arab Fund and PIF. Where both parties have reached an agreement on supporting SMEs in Palestine through improving access to finance. Arab Fund provided PIF with a 30M USD loan commitment to be allocated for SMEs in Palestine through financial intermediary institutions like (MFIs and leasing companies), in order to provide potential beneficiaries with affordable financing. Since the program inception, PIF has received a total amount of 12 million USD, which was disbursed to 7 institutions.

The investment in this program, achieved high impact levels in reaching more than 1,240 businesses/loans while creating and sustaining more than 2,500 Job opportunities by the end of 2018. The program provided 11.35M USD of loans to SMEs owned by young Palestinian entrepreneurs and helped endorsing additional 9.43M USD by business owners or by our MFI partners. The program managed to reach all governorates with diversified sectoral distribution. The female borrowers were around 45% of the total portfolio. In 2019 PsDF will continue working with the current partners and supervising the loans portfolio, in addition to providing between Around 10M USD to local MFI’s and leasing companies

Jerusalem Program

Jerusalem Financing Facility (EU/PsDF project)

Given their vital role in economic and social development, small and medium-sized enterprises (SMEs) lie at the heart of the Palestinian economy. That is why, the city of Jerusalem is believed to be largely dependent on maintaining efficient and ever-growing SMEs. Following the success of the first phase of Jerusalem Financing facility (More than 20 SMEs were supported during 2014-2017, 1.72M EUR grants were provided, and 110 new jobs were created), PIF and the European Union decided to launch a second phase of the Jerusalem Finance Facility, which targets the small and medium-sized Jerusalem businesses that operate mainly in a number of economic sectors. The program provides financing in the form of matching-grants (10,000 – 50,000 Euros) to businesses that prove their ability to implement its expansion plan and develop its business activities in order to achieve sustainable growth and sustain/create jobs for people in the Holy City and its surroundings. The program was launched in mid-2018 for the period of 36 months, with a total value of 2.30M EU. According to the agreed plan it is expected that 25-30 businesses will be supported IN 2019, noting that more than 55 SMEs are expected to be supported during the facility life (3 years) with more than 110 jobs to be created.

Jerusalem Old-city Intervention (Oxfam/Sida -PsDF project)

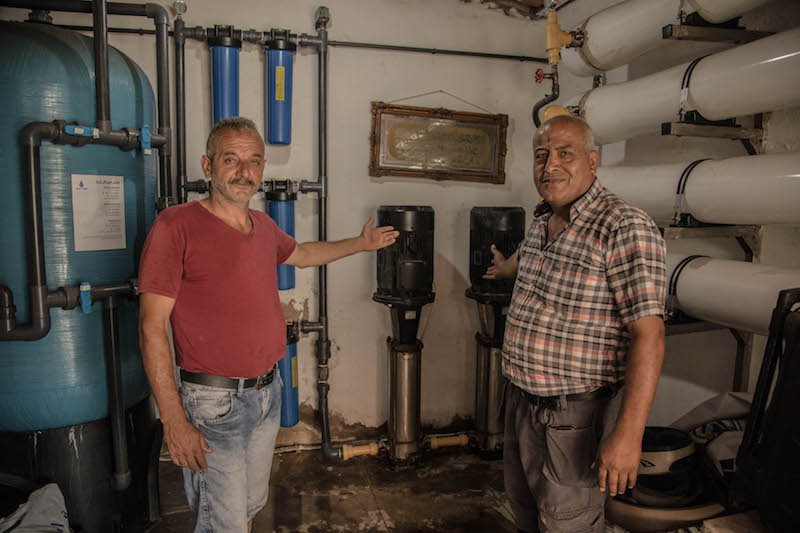

In 2018 PsDF, in collaboration with Oxfam with the financial support from SIDA, agreed to provide financing for small and medium businesses working to implement its expansion plan and develop its business activities. The program provided support mainly to finance the purchase of equipment and machinery that had impact on supporting the progress of work developing the project or assisting in the establishment of new ones mainly small-scale businesses. The average funding provided is around $10,000 (Matching concept – minimum 30% matching by the beneficiary). 9 projects were financed during 2018, where the facility will be working on monitoring, follow-up and finalizing the program in the first half of 2019.

Jerusalem Microfinance Facility

PIF signed an MOU with Arab fund back in 2011. The MoU stipulated that Arab Fund would provide 4.5M USD to support Jerusalem SMEs through providing loans indirectly by financial institutions. To date PIF received 1.44M USD as first tranche of the total grant allocated to Jerusalem. By end of 2018 around 53 loans were provided to Jerusalem SMEs, with a total value of 2.5M USD, covering different sectors including Manufacturing, Services, trading, and Tourism. More than 50 direct jobs were created through the help of financing. A new Contract with Palestine Development fund (Microfinance institution operating in Jerusalem) was signed in the end of 2018 with a total value of 2.30M USD. PsDF will follow-up on the loan disbursement process and monitor the implementation process by PDF.

Lebanon Economic Empowerment Program

Given the challenges and difficult living conditions Palestinian refugees endure, PIF/PsDF considers it its responsibility to support Palestinians in the diaspora, particularly those living in refugee camps in Lebanon. The program focuses on giving income generating loans to Palestinian Refugees ranging between 500 – 5000 USD. By end of 2018, more than 3,100 loans were provided in Palestinian refugee camps and communities, amounted to around 5.50M USD. The facility will be endorsing around 1M USD by revolving available funds through contracts signed in the end of 2018.

Corporate Social Responsibility – CSR

Stemming from PIFs belief in the importance of creating sustainable programs that advance the development of the Palestinian economy, PsDF allocates resources for supporting programs that contribute, both directly and indirectly to the development of the Palestinian economy. In 2018, PsDF supported 40 organizations working in the fields of education, economy, culture, health, entrepreneurship and others.

© All Rights Reserved for Palestine Investment Fund

MORE ABOUT PIF

LANGUAGES